What is Banking as a Service (BaaS)?

The evolution of the financial and banking sector involves the integration of technologies and the digitalization of services. Since the appearance of ‘Software as a Service’, which was a turning point, being able to offer a large number of services over the Internet is now possible.

Software as a service marked the beginning and it affected different sectors such as mobility, security, and finance.

Thanks to this, there are more and more companies that become fintech and new opportunities arise to digitize and offer better services to users.

In this post, we will talk about BaaS and how this facilitates business access to financial services. In addition, banking as a service also allows more fluid processes to be created to improve financial operations.

Keep reading to learn more about banking as a service (BaaS)!

Find out top 6 Digital Transformation Trends that will become popular in the coming years

What is BaaS?

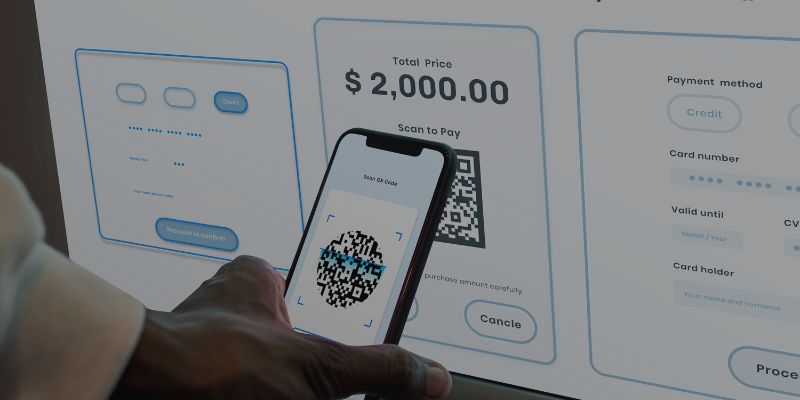

Banking as a service (BaaS) is a process that allows third parties to connect to financial systems and banking services thanks to the integration of APIs. This allows non-banking companies to incorporate financial services, thus creating more personalized solutions that benefit businesses and clients.

BaaS can be considered an evolution of software as a service in the banking environment. It allows companies to access financial services that were previously inaccessible. All of this is thanks to association with companies in the financial sector, thus adapting to businesses and improving processes.

Banking as a service benefits banking entities that improve their market share to fintech companies that can offer better services. Also, it benefits consumers who can access financial services from anywhere and at any time.

How does banking as a service (BaaS) work?

The popularity of banking as a service is growing at high speed, so in this post, we will tell you what banking as a service (BaaS) is and how it works.

A fintech company begins with the use of a BaaS platform and the provider offers an API to give access to the systems that the fintech company needs to create new services based on financial products.

In this way, companies take advantage of new business opportunities, for example, through subscription models or contracted services.

Each framework has its characteristics, advantages, and disadvantages and its use must be adapted. Find out the differences between React and Angular!

What is an API?

As you can see, in this process the integration of APIs is essential. APIs have been a revolution in the way of developing software solutions since they make processes easier and more agile.

The acronym API means Application Programming Interfaces and it can be defined as a protocol that allows the connection of two applications. These allow you to define how one part of software communicates with another to create the desired functionality.

These types of resources with numerous advantages are not seen in an app by users, but rather the developers are in charge of working with the different APIs to create unique solutions and user experiences.

Benefits of Banking as a Service

BaaS has different benefits such as: increasing the value of the customer cycle, creating new business opportunities, improving customer satisfaction, or simplifying processes.

Incorporating banking processes as a service drives the digitalization of the businesses that implement it. This demonstrates that by incorporating technologies and software that allow financial services to be offered, customer service is improved, increasing customer loyalty and saving time and resources.

- Increased customer cycle value

- New business opportunities

- Improved customer satisfaction

- Process simplification

The ABAMobile team has been developing customized software solutions for companies for more than 10 years. Contact us to begin developing your next mobile-focused project.

Get in touch with our team to start your next development project!